eSIM Vietnam for OTP Banking: Secure Your Online Transactions with Confidence

eSIM Vietnam for OTP banking is a must-have for anyone who needs to do online banking, receive transaction notifications, or verify accounts while in Vietnam. Whether you are an expat, business traveler, or digital nomad, banking in Vietnam requires a local phone number to receive OTPs (One-Time Passwords) via SMS for secure authentication. This guide explains why using a local eSIM is essential, how to set it up, and what to watch out for to keep your finances safe.

Why OTP Banking Is Critical in Vietnam

Online banking in Vietnam is fast, convenient, and widely used, but security is a top priority. Every transaction—whether transferring money, shopping online, or changing account details—typically requires OTP verification. Banks like Vietcombank, Techcombank, BIDV, and VPBank all send OTP codes via SMS to a Vietnamese phone number. If you don’t have a working local number, you can’t complete key actions or even access your accounts.

- Mandatory for transactions: All major Vietnamese banks require OTP verification for transfers, payments, and security updates.

- SMS only: OTPs are almost always sent via SMS, not email.

- International numbers rarely work: Vietnamese banking apps often reject foreign phone numbers or block international SMS due to anti-fraud measures.

- Expats, long-term tourists, and business travelers: You need a Vietnam phone number for banking, not just for data or calls.

What is an eSIM Vietnam for OTP Banking?

An eSIM Vietnam for OTP banking is a digital SIM card with a real local phone number (+84) that you install directly on your smartphone. It allows you to:

- Receive SMS OTP from Vietnamese banks in real time

- Register your mobile number with local banks and fintech apps

- Access digital banking and mobile payment services (Momo, ZaloPay, ShopeePay)

- Enjoy seamless calls, data, and full SMS support—no physical SIM swap needed

With an eSIM, there’s no need to visit a phone store or worry about losing tiny SIM cards. Just scan, activate, and bank securely from day one.

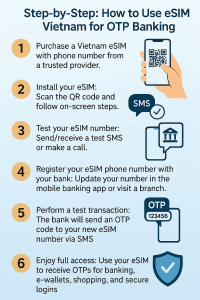

Step-by-Step: How to Use eSIM Vietnam for OTP Banking

- Purchase a Vietnam eSIM with phone number from a trusted provider (see GovnSIM below for verified options).

- Install your eSIM: Scan the QR code and follow on-screen steps.

- Test your eSIM number: Send/receive a test SMS or make a call.

- Register your eSIM phone number with your bank: Update your number in the mobile banking app or visit a branch.

- Perform a test transaction: The bank will send an OTP code to your new eSIM number via SMS.

- Enjoy full access: Use your eSIM to receive OTPs for banking, e-wallets, shopping, and secure logins.

Benefits of Using eSIM Vietnam for OTP Banking

- Real Vietnamese number (+84): 100% accepted by banks and financial services.

- Instant delivery: No waiting for physical SIMs at the airport or shops.

- Full SMS support: Receive all banking OTPs, security codes, and notifications.

- Convenience and flexibility: Use alongside your home SIM with dual-SIM phones.

- Secure and private: Avoid sharing your personal home number with Vietnamese apps.

Why International Numbers Fail with OTP in Vietnam

Banks in Vietnam have strict anti-fraud policies. International numbers are often rejected or simply do not receive banking OTP SMS due to:

- Carrier restrictions or blocking international SMS

- Banks only accepting local numbers for registration and verification

- Delayed or missing messages that cause transaction failures

With a Vietnam eSIM for OTP banking, you bypass all these issues with a real, locally routed phone number.

For more about why OTP SMS is critical for online banking, see this trusted article: What is a One-Time Password (OTP)? – IBM

Why Choose GovnSIM for eSIM Vietnam for OTP Banking?

GovnSIM specializes in eSIMs with local phone numbers verified to work with Vietnamese banks, digital wallets, and all OTP-dependent services. Enjoy instant setup, English support, secure payment, and flexible plans for all stay durations.

Frequently Asked Questions: eSIM Vietnam for OTP Banking

1. Can I receive all OTP banking SMS on my eSIM Vietnam number?

Yes, if your eSIM includes a real Vietnamese (+84) phone number with SMS capability. Always check that your provider explicitly supports banking SMS—data-only eSIMs will not work for OTP!

2. Do Vietnamese banks accept eSIM numbers for account registration?

Absolutely. Vietnamese banks treat eSIM numbers like physical SIM numbers, as long as they’re real local (+84) numbers. You can register, update, and receive OTPs normally.

3. How do I update my bank with my new eSIM number?

Log in to your banking app and update your registered phone number in the profile/security section, or visit a branch if needed. Most banks allow remote update if you have the app.

4. What should I do if I don’t receive OTP SMS on my eSIM?

Double-check that your eSIM plan includes SMS, and your number is correctly registered with your bank. Sometimes, a restart or waiting 10–15 minutes after activation resolves the issue. Contact GovnSIM support if the issue persists.

5. Can I use the same eSIM number for both banking and other Vietnamese apps?

Yes! One eSIM number can be used for banking, Grab, Zalo, Shopee, and all apps requiring a Vietnamese phone number for registration and OTP verification.

Troubleshooting: Common Issues with eSIM Vietnam for OTP Banking

- Did not receive OTP SMS? Make sure your eSIM includes SMS, not just data. Some cheap tourist eSIMs do NOT support SMS or banking OTPs.

- Bank rejects your number? Double-check you entered your number with the correct format (+84). If switching from a physical SIM, update the number in your bank’s records.

- OTP SMS delayed? Occasionally, network congestion or provider issues can cause delays. Most reliable eSIM providers (like GovnSIM) have strong SMS routing for banking.

- eSIM not compatible? Ensure your phone is eSIM-ready and unlocked.

- Security Tips: Using eSIM Vietnam for Secure OTP Banking

- Never share your eSIM QR code or activation info with anyone else.

- Buy only from reputable providers; avoid “unlimited” eSIM deals from unknown sources—they often lack SMS or security features.

- Set up banking alerts for every transaction using your new eSIM number.

- If you lose your phone, immediately contact your bank and eSIM provider to suspend service and prevent account fraud.

- Update all critical services (banks, e-wallets, business apps) with your new number once your eSIM is active.

Comparison Table: eSIM Vietnam for OTP Banking vs. Other SIM Solutions

| SIM Type | OTP Banking Support | Local Vietnamese Number | SMS Support | Activation Time | Convenience |

|---|---|---|---|---|---|

| eSIM Vietnam with Phone Number (GovnSIM) |

✅ Yes (100%) | ✅ Yes (+84) | ✅ Yes | Instant | ⭐⭐⭐⭐⭐ |

| Physical SIM at Airport/Shop | ✅ Yes | ✅ Yes (+84) | ✅ Yes | 15–30 mins | ⭐⭐⭐ |

| Data-Only eSIM | ❌ No | ❌ No | ❌ No | Instant | ⭐ |

| International Roaming SIM | ❌ Rarely Works | ❌ No | ❌ No | Varies | ⭐ |

Quick Checklist: Choosing the Best eSIM Vietnam for OTP Banking

- ✔️ Real Vietnamese (+84) phone number

- ✔️ Full SMS & OTP support (not data-only)

- ✔️ Provider reputation & English support

- ✔️ Fast activation and flexible plan options

- ✔️ Secure payment and personal data protection

Why More Expats and Business Travelers Trust GovnSIM

- Real local number guaranteed to work with Vietnamese banks and financial apps

- Fast, automated eSIM delivery – receive your QR code in minutes

- Clear guides and English customer support via WhatsApp or LINE

- Flexible plans for all stay durations (short visits, business, long-term expats)

- Trusted by 10,000+ international customers and hundreds of 5-star reviews

Ready to bank securely in Vietnam? Choose GovnSIM for eSIM Vietnam for OTP banking and enjoy seamless banking access wherever you go.

Learn more about one-time password security on this IBM explainer page.